.jpg)

In some contexts, residual value refers to the estimated value of the asset at the end of the lease or loan term, which is used to determine the final payment or buyout price. In other contexts, residual value is the value of the asset at the end of its life less costs to dispose of the asset. In many cases, salvage value may only reflect the value of the asset at the end of its life without consideration of selling costs.

How to Calculate Salvage Value

Sometimes, the thing might be sold as is, but other times, it might be taken apart and the pieces sold. So, salvage value is the money a company expects to make when they get rid of something, even if it doesn’t include all the selling or throwing away costs. The double-declining balance method doubles the straight-line rate for faster depreciation. With a 20% straight-line rate for the machine, the DDB method would use 40% for yearly depreciation.

Business Decisions

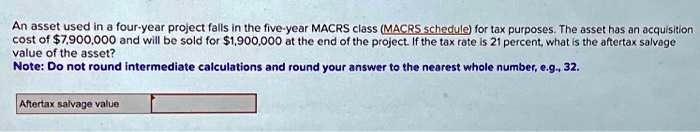

This guide aims to demystify the concept of after-tax salvage value, illustrating its importance in financial decision-making and providing a step-by-step process to calculate it accurately. An asset’s depreciable amount is its total accumulated depreciation after all depreciation expense has been recorded, which is also the result of historical cost minus salvage value. The carrying value of an asset as it is being depreciated is its historical cost minus accumulated depreciation to date. Salvage value is also called scrap value and gives us the annual depreciation expense of a specific asset.

- This means that the computer will be used by Company A for 4 years and then sold afterward.

- We can see this example to calculate salvage value and record depreciation in accounts.

- From there, accountants have several options to calculate each year’s depreciation.

- It exhibits the value the company expects from selling the asset at the end of its useful life.

- You could estimate it as a dollar figure or a percentage of what it initially cost you.

- In the case of capital losses, they can often offset other capital gains or be carried forward to offset future gains.

Центральний ринок (Central Market Hall)

Technological advances can significantly impact the determination of salvage value. As new and more efficient technologies emerge, older assets may become outdated and less desirable in the market. This can lead to a decline in their salvage value as buyers prefer assets with the latest technological capabilities. The level of maintenance and upkeep performed on an asset throughout its lifespan can affect its salvage value. Proper maintenance and regular upkeep can help preserve an asset’s condition and functionality, increasing its salvage value.

The original purchase price and any capital improvements to the asset determine the cost basis, affecting the gain calculation. A tax rate of 30% is applicable to when does the new york state tax department acknowledge e both income and gains and is not expected to change in 5 years. Tax code requires the company to depreciate the plant over 5 years with $10 million salvage value.

We plan to cover the PreK-12 and Higher Education EdTech sectors and provide our readers with the latest news and opinion on the subject. From time to time, I will invite other voices to weigh in on important issues in EdTech. We hope to provide a well-rounded, multi-faceted look at the past, present, the future of EdTech in the US and internationally.

Salvage value is a commonly used, if not often discussed, method of determining the value of an item or a company as a whole. Investors use salvage value to determine the fair price of an object, while business owners and tax preparers use it to deduct from their yearly tax liabilities. At this point, the company has all the information it needs to calculate each year’s depreciation. It equals total depreciation ($45,000) divided by useful life (15 years), or $3,000 per year. This is the most the company can claim as depreciation for tax and sale purposes.

Depreciation is an essential measurement because it is frequently tax-deductible. There are six years remaining in the car’s total useful life, thus the estimated price of the car should be around $60,000. The majority of companies assume the residual value of an asset at the end of its useful life is zero, which maximizes the depreciation expense (and tax benefits).

It is expected to stay economical for 5 years after which the company expects to upgrade to a more efficient technology and sell it for $30 million. Depreciation measures an asset’s gradual loss of value over its useful life, measuring how much of the asset’s initial value has eroded over time. From this, we know that a salvage value is used for determining the value of a good, machinery, or even a company. It is beneficial to the investors who can then use it to assess the right price of a good. Salvage value is defined as the book value of the asset once the depreciation has been completely expensed. It is the value a company expects in return for selling or sharing the asset at the end of its life.